Politics

UK ‘could fall into recession’ if interest rates hit 6%; mortgage rates keep rising; grocery inflation eases – business live | Business

UK “headed for recession if interest rates hit 6%”

The UK economy could fall into recession if the Bank of England lifts interest rates as high as some investors expect.

New analysis from Bloomberg Economics show that Britain could tip into a shallow recession if the Bank of England pushes its benchmark lending rate to 6%

Currently, the money markets indicates there’s a slightly greater than evens chance that BoE base rate hits 6% by February 2024, up from 4.5% at present (with a rise to 4.665% expected on Thursday). 🇬🇧Bank of England’s terminal rate expectations surge to 5.75-6.0% (currently 4.5%) due to higher-than-expected wage and core inflation data. Will the UK have the highest interest rates among G7 countries? Watching Thursday’s #BOE meeting for answers. pic.twitter.com/oUKOR5xsue — MacroMicro (@MacroMicroMe) June 19, 2023

Bloomberg has calculated that, if rates hit 6%, GDP would shrink by 1.4% in 2024.

“Our own view is that the pricing is probably overdone,” Dan Hanson, an economist at BE, wrote in a note published Tuesday.

Hanson adds:

“But if this tightening cycle has taught us anything, it’s not to underestimate the persistence of inflation.

The BOE may judge a significant slump is what’s needed to prevent the inflation psychology in the UK from becoming embedded.”

Because more people are on fixed-rate mortgages than a few decades ago, it will take longer for previous increases in interest rates to impact households

Hanson writes:

“With that in mind, we think there’s a significant risk of a downturn later this year — even on our relatively dovish policy view. If rates were to climb to 6% the slump would be even deeper.

Key events The cost of fixed-rate mortgages may continue to rise, unti the markets see signs that UK inflation is falling steadily. Nicholas Mendes, mortgage technical manager at broker John Charcol, explains:

My worry is that things may well get worse before they get better, while we expect inflation figures [on Wednesday] to come down the anticipation will be they in line with market forecasts. If not, markets will be pricing in higher base rates over a longer period of time. Despite the cost of living crisis, demand for cruises for the older-50s is holding up well. Saga has reported that its load factor (which measures how full its cruise ships are) is already 79% for the current financial year, up from 72% at this time last year. Underlying profits is expected to be well ahead of the prior year, with Saga’s River Cruise and Travel businesses on track to return to profitability. Euan Sutherland, Saga’s CEO, says:

“Four months into the financial year, we have continued to build on the momentum in our Cruise and Travel operations, while making further progress in our growth agenda through the development of our newer businesses. Year-end underlying profit is expected to be well ahead of the prior year. Buy-to-let mortgage rates have also risen again. Moneyfacts reports: The average 5-year buy-to-let residential mortgage rate today is 6.29%. This is up from an average rate of 6.23% on the previous working day. There are currently 2,525 buy-to-let mortgage products available. This is up from a total of 2,515 on the previous working day. Average two-year fixed mortgage rates in Britain have jumped to their highest since late November, as the turmoil in the mortgage market continues. Data provider Moneyfacts report that the average two-year fixed mortgage rate has risen to 6.07% this morning, up from 6.01% yesterday. At the start of May the average was 5.26%, but it has been rising steadily higher as financial markets have anticipated further rises in UK interest rates – possibly to 6%. The average cost of five-year fixed-rate mortgages increased to 5.72% from 5.67%, which is the highest since early December. There are also fewer mortgages on the market, too. Moneyfacts reports there are 4,641 residential mortgage products available today, down from 4,683 on Monday. Investors are still repricing their expectations for the Bank of England base rate, after the very strong employment data last week [showing faster wage growth], reports Jim Reid of Deutsche Bank. Reid says: One particular milestone from yesterday was that for the first time since the mini-budget turmoil, overnight index swaps were pricing in a 6% [Bank of England] base rate as more likely than not by the close, and not just on an intraday basis. The UK economy could fall into recession if the Bank of England lifts interest rates as high as some investors expect. New analysis from Bloomberg Economics show that Britain could tip into a shallow recession if the Bank of England pushes its benchmark lending rate to 6% Currently, the money markets indicates there’s a slightly greater than evens chance that BoE base rate hits 6% by February 2024, up from 4.5% at present (with a rise to 4.665% expected on Thursday). 🇬🇧Bank of England’s terminal rate expectations surge to 5.75-6.0% (currently 4.5%) due to higher-than-expected wage and core inflation data. Will the UK have the highest interest rates among G7 countries? Watching Thursday’s #BOE meeting for answers. pic.twitter.com/oUKOR5xsue — MacroMicro (@MacroMicroMe) June 19, 2023 Bloomberg has calculated that, if rates hit 6%, GDP would shrink by 1.4% in 2024. “Our own view is that the pricing is probably overdone,” Dan Hanson, an economist at BE, wrote in a note published Tuesday. Hanson adds:

“But if this tightening cycle has taught us anything, it’s not to underestimate the persistence of inflation. Because more people are on fixed-rate mortgages than a few decades ago, it will take longer for previous increases in interest rates to impact households Hanson writes:

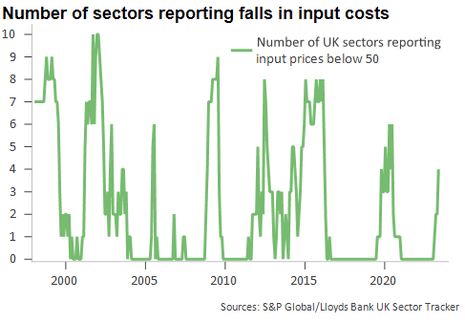

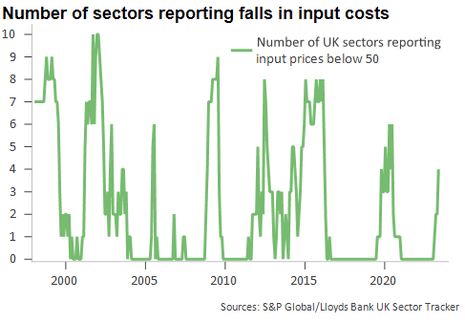

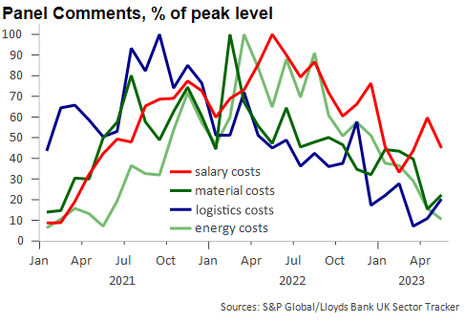

“With that in mind, we think there’s a significant risk of a downturn later this year — even on our relatively dovish policy view. If rates were to climb to 6% the slump would be even deeper. In the financial markets, Britain’s short-term borrowing costs have nudged up to a 15-year high. The yield (or interest rate) on UK two-year government bonds rose to 5.088% this morning, a day after hitting 5% for the first time since 2008. These two-year bonds are used to set mortgage prices, and are rising as the markets anticipate further increases in UK interest rates. The more vulnerable segments of society have been hit particularly hard by persistent inflation, points out Mohamed El-Erian, chief economic adviser at Allianz. The Context: Food #inflation has been persistent, hitting the more vulnerable segments of society particularly hard. — Mohamed A. El-Erian (@elerianm) June 20, 2023 Total spending on UK supermarket’s ‘own label’ value ranges has rocketed by 41% compared to last year, Kantar’s monthly data shows. This means the value section of the market has been the fastest growing segment every month since June 2022. The proportion of products sold for £1 in UK supermarkets, has almost halved in a year from 9% to 5%. That’s a big shift, reports Kantar, who argue that the cost of living crisis is discouraging retailers from riced products at ‘round-pound’ points. They explain: Traditionally, ‘round-pound’ prices have been attractive to shoppers, who find them easier to relate to and practical as well with no leftover change. 📈🛒 Interesting detail from monthly @Kantar supermarket inflation figures: — Harry Wallop (@hwallop) June 20, 2023 Aldi was the fastest growing UK retailer in the 12 weeks to 11 June, as cash-squeezed households flocked to discount suprermarkets. Aldi’s sales rose by 24.6%, giving it a new record market share of 10.2% – up from 9% a year ago Lidl grew its sales by 23.2%, and now has 7.7% of the market. UK supermarkets hiked prices of some summer favourites last month, such as icecreams and BBQ food. Fraser McKevitt, Kantar’s head of retail and consumer insight, says: The increased cost of staying cool will have come as a shock for many, with like for like prices on ice cream up 20% and mineral water up 17%. Newsflash: Food price inflation across Great Britain has eased, but prices are stil rising at a painfully high pace. Annual grocery inflation dropped to 16.5% for the four weeks to June 11, analysts at Kantar have reported, the lowest level recorded in 2023. That’s a fall from the 17.2% recorded a month ago, and below the record 17.5% recorded in March. But this still means supermarket prices are rising much faster than wages, or the wider measure of consumer price inflation (which was 8.7% in April – we get May’s figure tomorrow). Fraser McKevitt, head of retail and consumer insight at Kantar, said: “This is the lowest rate of grocery price inflation we’ve seen in 2023, which will be a relief to shoppers and retailers. First-time buyers are being hit by a drought in mortgages, as lenders pull back from offering home loans for those with small deposits. The number of products for borrowers who need to borrow 95% of the value of their home has dropped by over 40% over the past year, the Financial Times reports. According to data provider Moneyfacts, there were 199 products on offer over the weekend for would-be buyers looking to borrow up to 95 per cent of the value of the property, down from 347 at the start of June 2022. A 5% stake in the housing game is a risky bet for both the house & the player in a mkt downturn – According to @Moneyfacts_couk mortgage products for buyers looking to borrow up to 95% of the value of a property saw their options reduce from 347 at the start of June to 199 @FT pic.twitter.com/I1b7N96GFW — Emma Fildes (@emmafildes) June 20, 2023 A glimmer of good news – the input production costs of UK food and drink manufacturers have fallen for the first time since April 2016. This provides optimism that future food price inflation will ease, reports Lloyds Bank, athough they fear it will be “some time” before this feeds through “if at all” to on-the-shelf food prices. Food and drink producers benefited from a drop in commodity prices last month, with the prices of vegetable oils, cereals and dairy products falling on the global markets. The cost of shipping, and energy, both eased in May too, helping to reduce cost pressures. But, Lloyds Bank’s UK Sector Tracker found that salary inflation is the ‘stickiest’ element pushing up prices. Annabel Finlay, managing director for Food, Drink and Leisure at Lloyds Bank Commercial Banking, explains:

“This drop breaks sustained rises in production costs for food and drink manufacturers, which have been among the sharpest of any sector monitored by the Tracker. Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy. Britain’s cost of living squeeze is rocking the property sector, driving up cost for tenants and mortgage-owners alike. With rents rising faster than wages, the average UK tenant is now spending more than 28% of their pay before tax on rent, figures compiled by property portal Zoopla shows. That means people are spending more of their wages on rent than at any other time in the last 10 years. Average rents for new lets have also risen, Zoopla reports – jumping 10.4% in a year. With wages only growing by 5.7% during 2022, it has become harder for people to afford places. In April, rent in London was 13.5% higher than a year ago, in Scotland it was 13.1% higher, and the North West of England saw a 10.5% increase. Richard Donnell, executive director at Zoopla, said there was signs of financial “stress” for tenants, particularly those on low incomes. Donnell adds:

“The impact of higher rents is not uniform with those on low incomes bearing the brunt, with increasing signs of stress.” NEW @Zoopla rental report finds 1) rents for new lets have outpaced earnings for 21 months, 2) Rental affordability worst for a decade but 3) talk of landlord exodus overdone – higher mortgage rates hit 20-30% of landlords with >50% LTV loans pic.twitter.com/wiW6pKWb8q — richard donnell (@richard_donnell) June 20, 2023 Those looking to remortgage also face more stress, given the recent increases in borrowing costs. Yesterday, the cost of the average two-year fixed rate mortgage hit 6% for the first time since December, but the government is resisting calls to help struggling mortgage-payers. TSB has became the latest lender to pause sales of some of its mortgages, by removing some products at 4pm yesterday. At 8am we discover if food price inflation eased in the last month, when market research group Kantar releases its latest assessment of the grocery market. Investors are digesting an overnight rate cut in China overnight. The People’s Bank of China has cut its one-year and five-year loan prime rates 10 basis points each (0.1 percentage point), as Beijing tries to stimulate its economy. 8am BST: Kantar monthly report on UK grocery industry 10am BST: Eurozone construction output in April 1.30pm BST: US housing starts and building permits data for May“Things may well get worse before they get better” for mortgage pricing

We also have the MPC meeting on Thursday which will also play a part in market reaction following the governors’ comments.

Markets need stability and a positive outlook for the future, once we have this in our sights this is when we will see swaps reduce and start to see fixed rate pricing come down.

Homeowners need to understand that sub 2% rates aren’t the norm and should not be used as a benchmark of where rates will return to in the future. A mortgage is a long-term commitment which ultimately means you must take the rough with the smooth.

“We have taken strong bookings for our ocean cruises with a load factor that is ahead of the same point in the prior year, and our River Cruise and Travel businesses are on track to return to profitability in line with previous guidance.Two-year fixed mortgage rates hit 6.07%

This positioning comes ahead of a pivotal few days for UK macro, since we’ll get the May CPI [inflation] release first thing tomorrow, and then the Bank of England’s latest policy decision on Thursday, where another 25bp hike is widely expected.UK “headed for recession if interest rates hit 6%”

The BOE may judge a significant slump is what’s needed to prevent the inflation psychology in the UK from becoming embedded.”

The Latest: Grocery prices in the UK rose by 16.5% in the last month, down from the prior 17.2%.

What Next: Tomorrow, we get the more comprehensive inflation data…Fewer products on sale for £1

But, with retailers eager to offer value and cash buying less popular, £1.25 has emerged as an increasingly important price point. It now vies with £2 as the second most popular price for a grocery item.

“The proportion of products sold for £1, the single most popular price for a grocery item, has almost halved in a year from 9% to 5%. That’s a big shift.”Discount supermarkets grow market share

The barbecue spread has equally been hit. Fresh sausage prices have risen by 16% while fresh burgers increased by 13%, showing how grocery price inflation is continuing to hurt consumers at the till.Grocery inflation drops to 16.5%, lowest level this year

“But prices rising at 16.5% isn’t something to celebrate and it’s still the sixth highest monthly figure in the past 15 years.

“Price rises are now being compared to the increasing rate of grocery inflation seen last summer, which means that it should continue to fall in the coming months, a welcome result for everyone.”First-time buyers struggle as lenders pull mortgage deals

The average interest rate on a two-year fixed 95 per cent loan-to-value mortgage jumped by more than 3 percentage points to 6.49 per cent over the same period, while for five-year products it rose more than 2 percentage points to 5.8 per cent.

“The constant rate changes and ongoing market uncertainty is causing havoc,” said Aaron Strutt, director at Trinity Financial. “First-time buyers are struggling to access mortgages, especially if they have smaller deposits.”Food and drink inflation pressures ease

“If production costs continue to fall, whilst welcome, it will still take some time before we see the benefit in terms of shelf prices. This is, in part, due to the long-term nature of contracts between the manufacturers and retailers, as well as the broader segments of the production chain.

“With the continued risk of future disruption to supply chains that could mean input costs rising again, food and drink manufacturing companies should continue to review their supply relationships and optimise their working capital to help shield against any market shocks and build ongoing resilience.”

Introduction: Tenants squeezed as rent takes up 28% of pre-tax pay

Also coming up

The agenda

//platform.twitter.com/widgets.js

Graeme Wearden

Published: 2023-06-20 10:13:33

Source