www.bloomberg.com

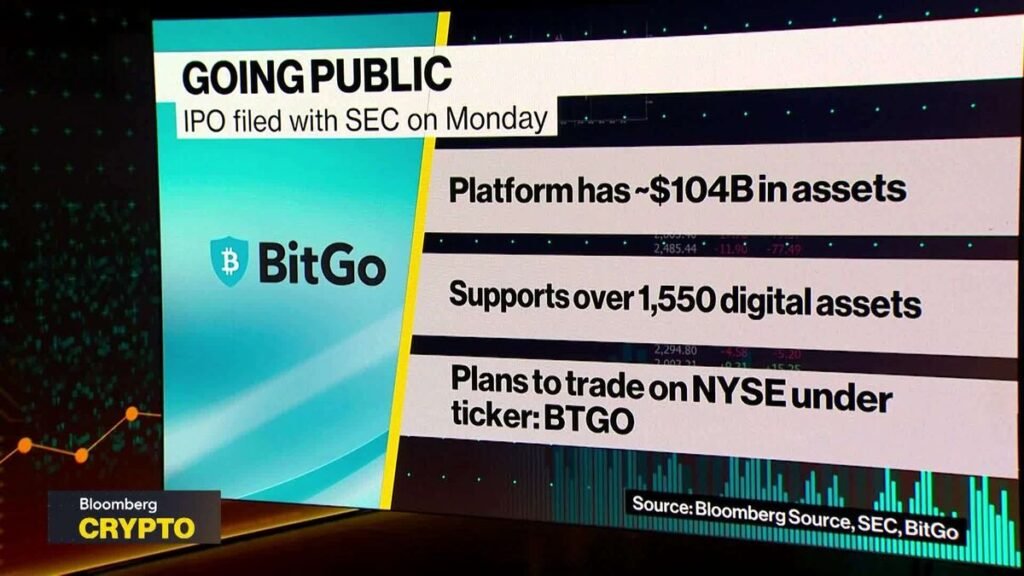

BitGo Holdings and its backers are targeting up to $201 million through an initial public offering, positioning itself as the first cryptocurrency company to move forward with listing plans in 2026. According to a Monday filing with the U.S. Securities and Exchange Commission, the Palo Alto-based startup plans to offer 11.8 million shares priced between $15 and $17 each. This move marks a significant milestone for the crypto sector, which has seen volatile market conditions and regulatory scrutiny in recent years. BitGo, known for its digital asset custody services, aims to capitalize on growing institutional interest in secure crypto infrastructure despite ongoing market uncertainty.

Read More