www.bloomberg.com

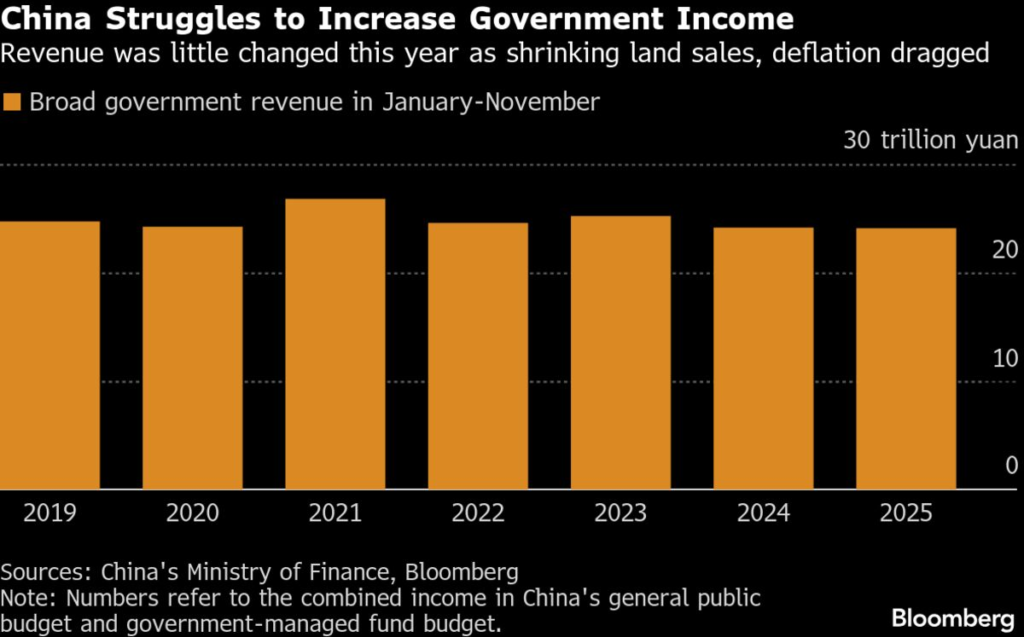

China is intensifying efforts to tax its citizens’ mountain of undisclosed overseas assets as authorities attempt to1 plug a widening budget deficit. The move targets undeclared foreign income and assets held in offshore accounts, properties, and investments. Official media reports the tax authorities will offer a "leniency period" where citizens can voluntarily disclose assets and pay owed taxes without penalty. However, harsh penalties, including potential criminal charges for non-compliance, will follow after the amnesty window closes. This nationwide campaign aims to uncover billions in lost revenue, reflecting Beijing’s increasing transparency pressure and desperate need for funds amid a slowing economy. The move fears investors globally, signaling a significant policy shift to claw back capital flight.

Summary (100 words):

China is ramping up taxation on undisclosed overseas assets to address a widening budget deficit. Authorities are targeting undeclared foreign income and offshore holdings, offering a temporary "leniency period" for voluntary disclosure and tax payment without penalties. After this amnesty window, non-compliant citizens face harsh fines and potential criminal charges. This nationwide campaign seeks to recover billions in lost revenue, reflecting Beijing’s increased pressure for financial transparency and its urgent need for funds amid a slowing domestic economy. The crackdown signals a significant policy shift to combat capital flight and is causing concern among investors worldwide.