www.bloomberg.com

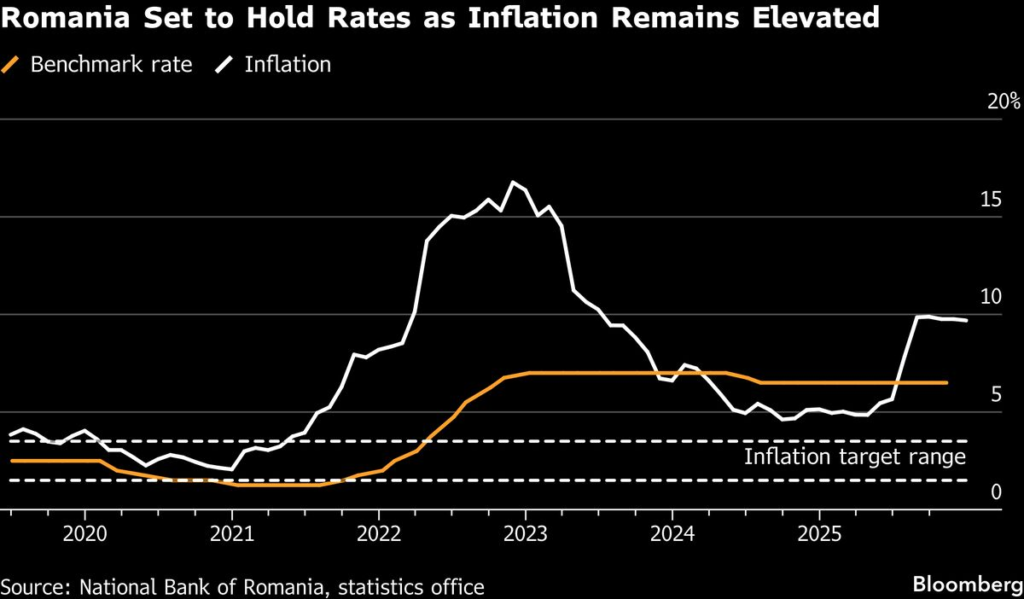

Romanian policymakers are expected to maintain one of the EU’s highest interest rates to curb persistent inflation, which remains near 10% with only a gradual slowdown anticipated. Recent data shows inflation unexpectedly rose in May to 9.9%, extending a streak of price pressures that has lasted over a year. Despite a 440-basis-point hiking cycle since mid-2022, the National Bank of Romania (BNR) signaled it will keep its key rate at 7% for now. This tight stance reflects concerns over sticky services inflation, rising wages, and weak domestic production, all overshadowing a growth-targeted fiscal policy ahead of December elections. While some analysts forecast a potential rate cut by year-end, BNR officials stress the need for prolonged moderation. Forex markets have responded to the steady policy, with the leu holding near record lows against the euro.

Read More